WorldCom Scandal: Collapse Due to Poor Risk Management

In the early 2000s, WorldCom was synonymous with reliability in telecommunications, a company that, after almost 20 years in the market, was positioned as the second-largest provider of long-distance telephony in the United States. However, by 2002 the company became a reference of fraud after one of the biggest accounting scandals in history was unveiled, which marked a before and after.

Join us, and discover the essential details of the WorldCom fraud, how it happened, what they did, what elements they could not handle, and how the lack of sound financial risk management produced severe consequences.

Let's dive in!

WorldCom: a telecommunications giant

To better understand the subject, it is necessary to understand what WorldCom was and what it did. WorldCom was an American telecommunications company founded in 1983 by Bernard Ebbers, its CEO, Murray Waldron, and William Rector, its business partners. It started its operations with an estimated capital of $650,000.

Year after year, WorldCom gained a vital market share after successfully applying powerful marketing strategies and attractive discounts for its customers, encouraging them to make long-distance calls. Finally, the progressive acquisition of smaller competing companies, also cell phone providers, allowed it to become the second-largest telecom company in the US by the 1990s.

By the mid-'90s, the company had a growth of $175 million; so far, so good; what was behind its success? How did the scandal originate?

Keep reading!

How did the WorldCom fraud happen?

1. The bursting of a bubbleRemember that exponential growth we mentioned above? It resulted from the rapid five-fold increase in the value of technology companies' shares from 1995 to 2000, which became known as the dot-com bubble. However, as everything goes up, it has to come down at some point. Unfortunately for WorldCom, when the bubble burst, they were unprepared to deal with multi-million-dollar losses and significantly reduced expenses from their business operations.

2. Questionable accounting practicesTo cope with the financial meltdown after the dot-com bubble and to avoid going bankrupt like other technology companies of the time, WorldCom deviated from the proper operation of its accounting activities and to preserve that image of financial growth and profitability that made it so attractive to new investors, they altered their actual accounting figures.

Why did they have to resort to this? To position itself in the telecommunications market and slow down competitors, the company quickly acquired more than 30 smaller technology companies. Still, with the more than 77% drop in technology stock prices on the stock market, WorldCom was in the red and could not continue.

However, shareholders wanted to prove that the company was still a reliable investment, so they decided to hide and alter its financial status and inflate its net income. WorldCom's books recorded expenses as investments in a dramatic way; for the year 2001, its estimated revenues were $3.8 billion, and more strikingly, in the first quarter of 2002 alone, it had reported profits of about $1.4 billion, which was the actual value of the losses.

3. Suspicious inconsistencies

The risk management team was crucial in bringing WorldCom fraud to light. When the vice president of the audit department at the time, Cynthia Cooper, became suspicious of the glaring inconsistencies, she contacted Gene Morse, an internal auditor, to conduct an in-depth analysis of the accounting. But they encountered several roadblocks along the way and questioning from managers such as Scott Sullivan.

In their investigation, Cooper and Morse found that the company's reserve funds were used to simulate revenue, transactions that could not be verified, and impressive capital expenditures over revenue.

Pro tip: conduct internal audits of your company 1 or 2 times a year to learn about weaknesses and potential threats that could affect your company's performance and generate losses.

4. The collapse of a giant

Following the audit department's findings, the dramatic decline began, with WorldCom having to present the actual profit figures for the 1990s, only $11 million. According to the audit team, the WorldCom fraud amounted to almost $80 billion, so there was no choice but to declare bankruptcy.

The revelation of the WorldCom scandal led to the sentencing of its CEO Benard Ebbers to 25 years in prison and Scott Sullivan to 5 years.

Finally, in 2004, two years later, the company was acquired by a group of investors and renamed MCI; then, in 2006, it was acquired by Verizon.

Deficient financial risk management consequences

In WorldCom's downfall, several factors were critical to the disaster besides their CEO and CFO, the main one being poor financial risk management, a limited focus on their market, and flawed analysis of the investments made allowed them to be caught off guard by the drop in stock value.

Another area for improvement of their financial risk management was the need for internal and external audits to see what was happening in the company. There also needed to be more supervision and effective compliance with corporate regulations and sound accounting practices. By 2002, when a thorough investigation of the problem was attempted, it was too late, and the consequences were imminent.

How can risk management software like Pirani make a difference?

In the WorldCom case, poor financial risk management and inappropriate behavior resulted in one of the most infamous accounting frauds of the early 2000s.

The underlying problem, beyond the questionable accounting practices, is the lack of follow-up by the company and risk management teams on operations, verifying the authenticity of data, verifying the provenance of funds in the transactions captured, tracking activities and their progress to provide transparency and enhance the confidentiality of the company.

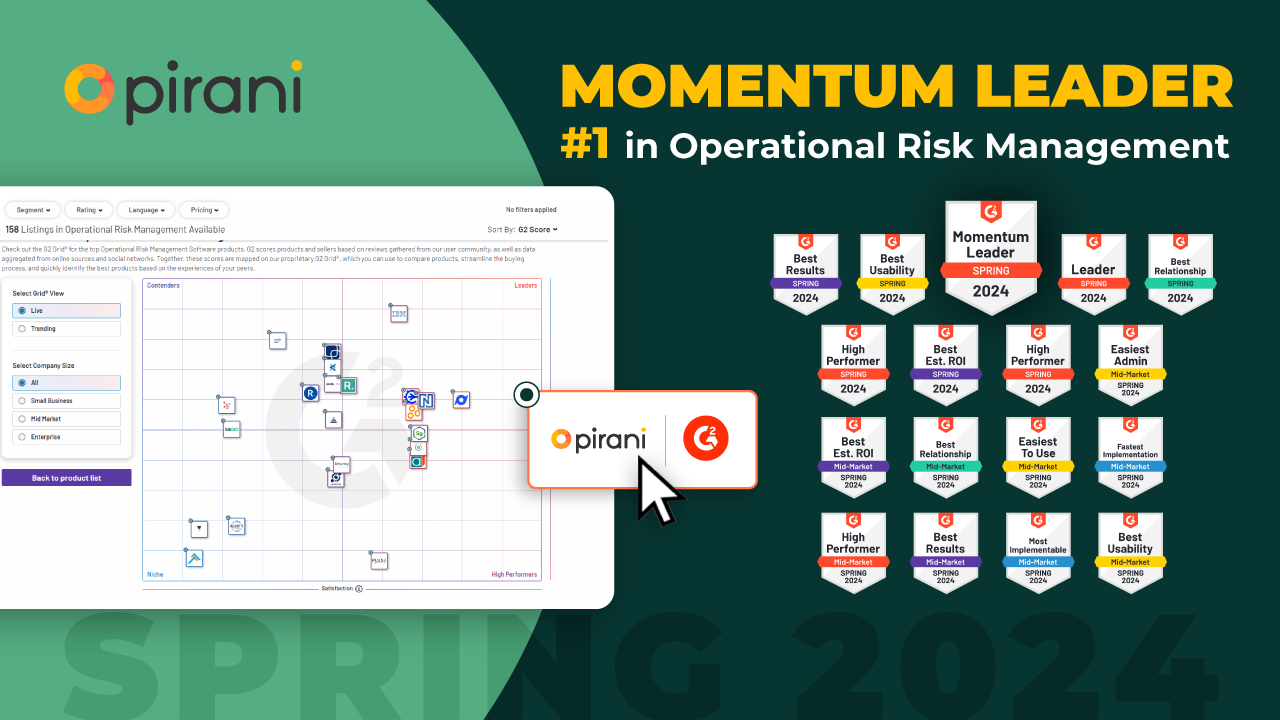

Dedicated solutions such as Pirani could be an ally to avoid these mistakes since risk management software allows to verify compliance with regulations and business standards. It also ensures that the data processed at each level and area is truthful and authentic. These tools enable risk managers to perform continuous audits to evaluate the performance and improve the company's operation, correct its weaknesses to strengthen its security, and control the exposure to threats.

Did you know about the WorldCom case, and did you find it interesting?

Let us know in the comments!

You May Also Like

These Related Stories

Enron case study: one of the worst frauds in history

Pirani earns 14 new badges on G2

Top 10 Best Information Security Software

Anti-Money Laundering Solutions: How to Make the Correct Segmentation for Money Laundering

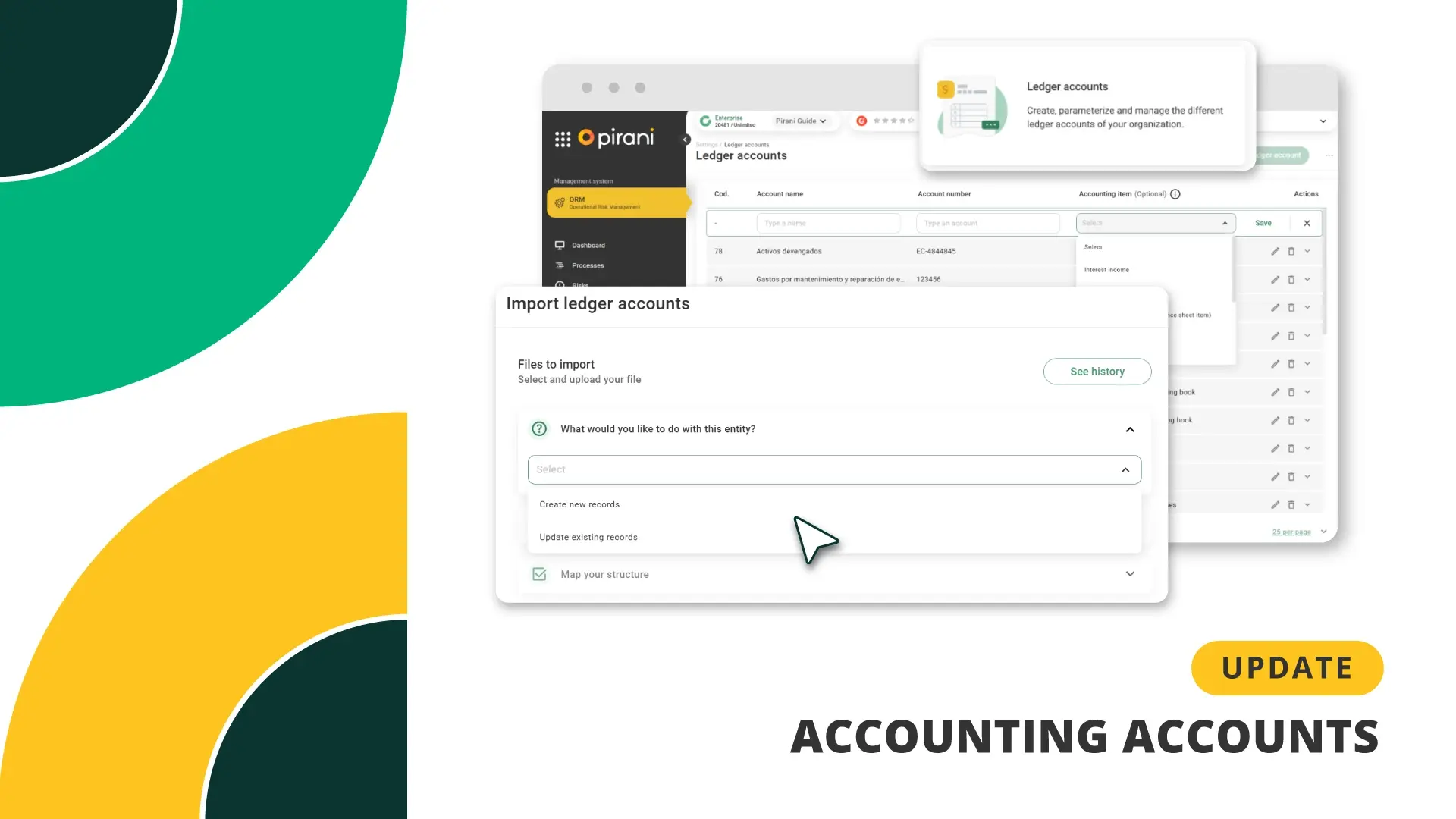

Accounting Accounts in Risk Management

Comments (1)