Navigating Operational Risk Management: An Overview

Companies today have to navigate through many internal and external events to manage and grow their success. Understanding and effectively mitigating operational risks becomes a huge factor influencing the journey.

Operational risks often encompass a wide spectrum, ranging from human errors and cyberattacks to financial instabilities and natural disasters. The intricacies of managing operational risks are understood by their potential to disrupt business operations, impact financial strength, and even lead to significant losses.

Within these complex terrains, Pirani Risk emerges as a beacon of innovation and education for risk managers.

In this article, we’ll review the various types of operational risks that businesses encounter and delve into Pirani Risk’s transformative approach toward operational risk management.

What is Operational Risk Management (ORM)?

Operational risk, often abbreviated as ORM, is a critical facet of risk management within the modern business landscape.

In the world of financial services and financial institutions, the Basel Committee on Banking Supervision defines operational risk as the risk of loss resulting from inadequate or failed internal business processes, systems, people, and external events.

Understanding the significance of operational risk is crucial because it stands apart from other types of risks that businesses encounter. Unlike market risk or credit risk, which are more externally driven, operational risks are inherently tied to the internal processes of a business.

They can also manifest in various forms. While financial risks can affect the bottom line, poor operational risk management can disrupt the core of a business’s operations.

The operational risk management process requires unique strategies and methodologies tailored to an organization's specific operational risk profile.

The Four Primary Sources of Operational Risks

Operational risks can be categorized into four main sources, each coming with its own unique set of challenges:

- People: Human errors, misconduct, or lack of adequate training can pose significant operational risks. While human resources are the backbone of any organization, they can also be a source of vulnerabilities. Employees may inadvertently make mistakes, intentionally engage in misconduct, or lack the necessary skills and training to perform their roles effectively.

- Processes: Inefficient or outdated processes and procedures can lead to operational risks. Organizations that rely on outdated, inefficient processes are more prone to disruptions as these methods can affect the agility and adaptability of the business, making it less capable of responding to changing circumstances and customer demands.

- Systems: Technological failures and cyber-attacks are a growing concern in the digital age. System failures, software glitches, or malicious cyberattacks can disrupt operations, compromise data security, and result in substantial financial losses. With businesses increasingly relying on technology, these technology risks are more relevant than ever and play a vital role in determining cybersecurity.

- External Events: Natural disasters, geopolitical issues, or regulatory changes can have far-reaching consequences on operations, even affecting business continuity. The unpredictability of these events makes them challenging to manage but absolutely essential to consider in ORM.

Benefits of a Robust ORM Framework

A well-established enterprise risk management framework, such as creating a business continuity plan, offers a host of compelling benefits that extend beyond reducing your level of risk and risk mitigation. Here are some key advantages:

- Improved Operational Efficiency: An effective ORM framework streamlines processes and efficiently allocates resources. It helps identify and rectify bottlenecks, redundancies, and inefficiencies in business operations, contributing to improved productivity and cost savings.

- Reduction in Loss Incidents: ORM is designed to proactively identify, assess, and mitigate risks, reducing the likelihood of any operational losses through unnecessary risks. Businesses can significantly minimize financial setbacks and operational disruptions by addressing potential risk factors at an early stage.

- Enhanced Reputation and Stakeholder Trust: Effective ORM demonstrates a commitment to responsible business practices. By safeguarding against operational disruptions and crises, businesses can enhance their reputation and build trust with stakeholders, including customers, investors, and regulatory authorities.

- Better Compliance with Industry Regulations: This isn’t just a legal requirement but also a fundamental aspect of responsible business operations. A well-structured ORM framework ensures that a business is aligned with relevant regulations and standards, reducing the risk of non-compliance-related penalties.

Key Steps in the ORM Process

Operational Risk Management involves a structured approach with several key steps to ensure comprehensive risk mitigation. These steps are fundamental in the operational risk management function:

- Risk Identification: The first step is spotting potential causes and consequences of risks in your operations. This involves doing a deep dive into your company’s internal and external environment, pinpointing vulnerabilities, and understanding how various factors interact to create risk scenarios.

- Risk Assessment: Once identified, operational risks have to be assessed. This step involves evaluating the likelihood and potential impact of each identified risk. A careful analysis helps prioritize risks by using key metrics, allowing organizations to focus their resources on the most critical areas.

- Risk Mitigation: To address operational risks effectively, mitigation measures are implemented. These measures can include actions to reduce, transfer, or accept the risk. Implementing preventive and contingency measures is essential to minimize the impact of potential disruptions.

- Continuous Monitoring: Remember that operational risk is not static. It evolves with changing trends and environments. Keeping an eye on the risk landscape and adjusting strategies accordingly to emerging threats is key.

- Reporting: Communicating risk findings and strategies to stakeholders is essential. Reporting can help create transparency and ensure that senior management, boards, and other relevant parties are informed about the organization’s risk exposure and how it’s being managed in line with their risk appetite.

Integrating ORM with Overall Business Strategy

Operational Risk Management serves as the guardian of a business's operations and assets. Aligning ORM with business goals is crucial because it ensures that risk management is not a hindrance but an enabler of strategic success.

By integrating ORM into the fabric of the business strategy, an organization can:

- Safeguard its long-term sustainability by proactively identifying and addressing potential risks that can jeopardize strategic initiatives.

- Enhances stakeholder trust and reputation.

- Streamline risk management efforts while aligning resources in the right areas.

By integrating ORM into your decision-making and resource allocation efforts, you can:

- Identify which risks are critical to your achievement of key goals, and prioritize resources for those.

- Ensure that you develop a conscious risk culture by involving employees in managing operational risks.

- Facilitate a data-driven approach to risk management.

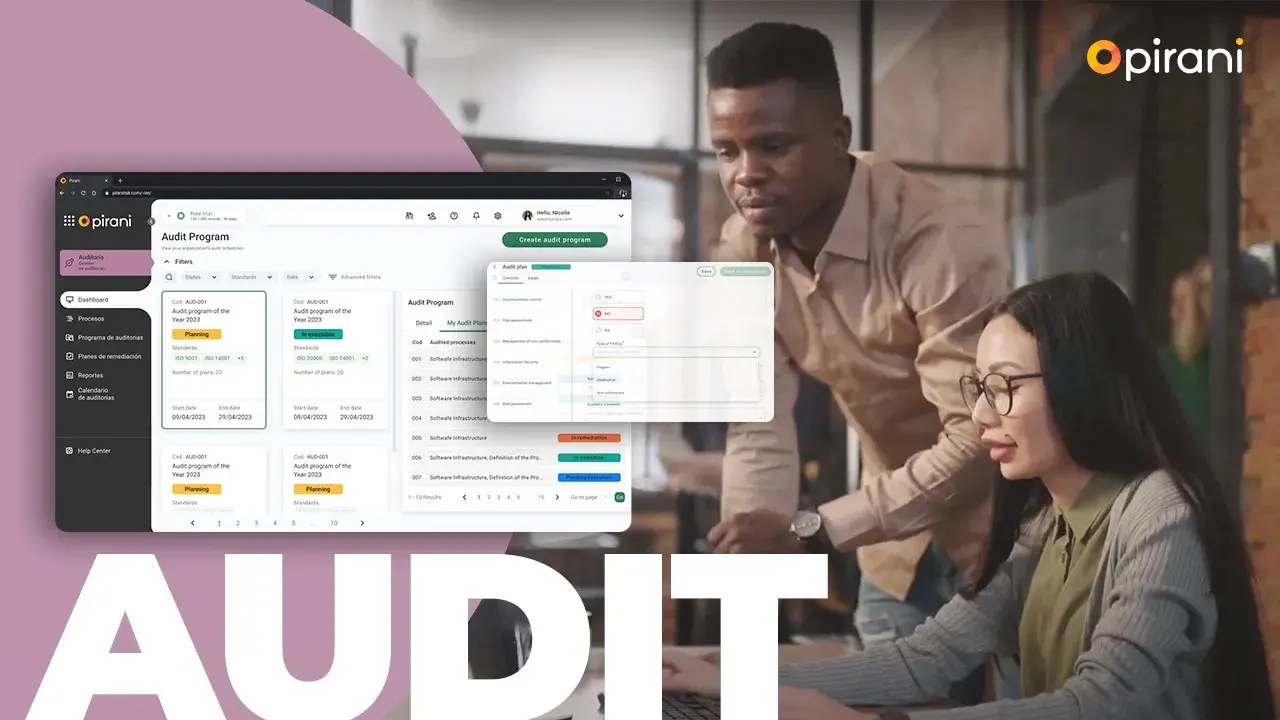

Pirani Risk is Tailored to Handle Operational Risks Seamlessly

In today’s volatile and unpredictable business landscape, operational risk management is not an option. It’s a non-negotiable imperative.

As organizations grapple with various internal and external influencing factors, ORM has emerged as a linchpin for long-term sustainability and resilience.

Always remember that ORM is not a static endeavor—it's an ongoing and dynamic process that requires continuous vigilance and adaptability. Businesses must be equipped to identify and respond to new risks as they emerge, ensuring that they don’t disrupt operations or lead to substantial potential losses.

Pirani Risk’s platform leverages state-of-the-art technology to empower businesses with:

- Real-time Monitoring: Stay ahead of operational risks with real-time monitoring. Get access to a dynamic dashboard that keeps you informed about the latest risk events and key risk indicators, helping you take swift and informed action.

- Risk Management Support: Expertise in risk management is just a click away. Whatever your organization requires to handle operational risks efficiently and seamlessly, our support team is here to assist.

- Easy Reporting Tools: Whether it's sharing data with stakeholders or regulatory authorities, the platform streamlines the reporting process of risk control.

To experience the transformative capabilities of Pirani Risk firsthand, we invite you to sign up for a free plan.

So what are you waiting for?

Take the first step in fortifying your organization against operational risks and safeguarding its future!

You May Also Like

These Related Stories

How to Create a Business Continuity Plan

Legal risk management in organizations

How to make an internal audit plan?

Operational Risk Management: Strategies and Examples

What is a key risk indicator (KRI)?

No Comments Yet

Let us know what you think