Excel vs. Cyber-Risk Management Platform: Better Option to Mitigate Risk

Companies are exposed to uncertain future events that may threaten the healthy functioning of business organizations; according to a PwC risk study, 77% of companies suffered operational surprises in the past 5 years due to unidentified risks.

To mitigate this risk, they rely on different tools to plan and monitor all their activities, industry, and the market to prevent and reduce the threat before it materializes.

Companies use two types of tools: an Excel matrix or rely on enterprise risk management technology to plan, classify and prioritize their activities to identify potential risks and threats to the execution of their actions.

Join us today and discover the main differences between the two risk management methods and which one is the best option for your company.

Excel as a risk management solution

Excel is a tool created by Microsoft that is valuable and quick to use for those who have experience with the program; that allows companies to create spreadsheets in which they can plan their projects, prioritize activities and determine the possible setbacks they may face in the execution of their business operations.

Purpose

Business organizations use Excel to analyze and visualize potential hazards through risk matrices. These are spreadsheets that include in their columns all possible variables that can impact the organization's healthy functioning or the execution of a project.

The objective is to identify and understand the level of risk exposure, reduce threats before they occur, and ultimately avoid financial losses, reduced revenue, or dissatisfied customers.

Find out how it works!

How does Excel risk management work?

For risk management operations through Excel, the first thing to do is to create a spreadsheet, in which, one by one, you will identify the risk and manually enter in each column the variable to be analyzed, for example, the risk (which you consider a threat to your operations), the type of impact (acceptable, tolerable, undesirable), the probability of occurrence (possible or impossible) and the level of danger (low, medium, high, extreme).

While it's a valuable tool, it has downsides!

Keep reading!

Cons of using Excel in risk management

- Technical knowledge: Staff must be knowledgeable about using it; not all staff are familiar with it, and training costs can be high.

- Connectivity limit: It is an option available only for computers.

- No synchronization: Only one staff member can use the tool.

- No automation: data and variables are added manually by team members.

- Less effective: It implies a more significant investment of time when entering the data of the activities.

- Less security: the information is exposed to cyber-attacks and can be opened by anyone.

- It is not an intuitive solution: it needs to guide users to use it.

- It is not a specialized tool, so it is not designed to fit companies' internal processes.

- Limited compatibility: It only works with Windows.

Let's see what enterprise risk management technology they offer!

Why use a Cyber-risk management platform?

Platforms such as Pirani are specialized software tools for the in-depth analysis, identification, control, and mitigation of all kinds of operational risks within an enterprise. These are dedicated software configured to national and international norms, standards, and protocols to establish an effective risk management culture in each company.

A risk management solution has a configuration that adjusts to the internal processes of each organization to collect and process the necessary data for each activity.

Let's see how Pirani does it!

How does enterprise risk management technology work?

When a company like Pirani is hired for risk management, after listening to the needs and requirements of the company, a customized configuration is established to fit the type of internal processes that the organization has; it is not the same for a health institution as for a financial or insurance company.

Then the platform is adapted to the national standards and work regulations that must be complied with in the countries where the company operates.

Once the software is installed and ready to use, the adaptation process is straightforward. With friendly tables and graphs, this platform type is characterized by intuitively guiding users to know where everything is and what to do.

Pirani is a centralized platform for monitoring and controlling activities; it collects, processes, and analyzes data from all work areas and compares it with risk histories in previous operations to determine the possibility and impact of risk.

It provides 360º visibility of operations and ensures real-time tracking of all members based on risk indicators as each activity progresses. Based on a simple color-coded system, it prioritizes each type of risk. It includes reports with easy-to-understand charts and graphs to optimize decision-making quickly and mitigate risk.

Pro tip: ensure the risk management solution is compatible with the different internal systems used in your organization, such as CRM, EPR, OMS, etc.

Find out what advantages it offers!

Pros of using an integrated risk management solution

- Fast learning curve: low level of technical knowledge.

- Security: protects your data against data leaks or any cyberattack.

- Automation: use the dashboard to load each operation data.

- Centralized: all the information on the operations is in one place and is available to all members.

- Fast: An event or activity can be added immediately to see what part of the production process will be affected.

- Teamwork: Allows one or more members to work on the platform.

- Easy integration with different business tools.

- Compatibility with mobile devices for permanent connectivity.

- Data synchronization.

- Real-time monitoring.

- Alerts on events.

- Risk operation history.

- Create risk reports at any time; click on download.

- 24/7 support.

Conclusion

Risk management is crucial for companies to stay afloat and have opportunities to grow; using the proper methods to manage them can make the difference between overcoming the crisis and closing. Tools such as Excel may seem a tempting option because it implies a lower cost of implementation. However, it means more dedication and effort limiting productivity; members must concentrate on uploading information and creating spreadsheets instead of what their products, services, and customers do.

Pirani risk management solutions simplify and streamline risk management so that companies can have maximum visibility into every activity and stay ahead of the curve and make informed decisions to stay ahead of the curve.

Did you like this article and want to know more about Pirani?

Let us know in the comments!

You May Also Like

These Related Stories

Excel Matrix vs. Risk Management Software: Which is better?

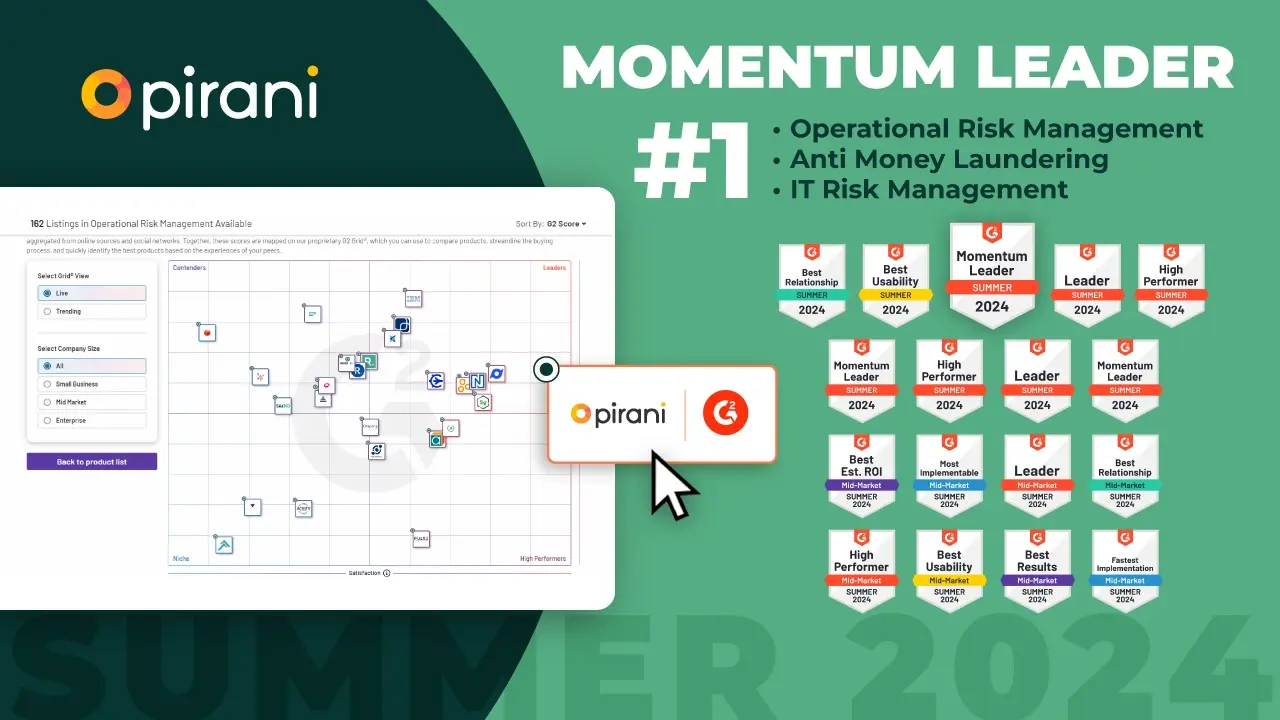

Pirani Recognized as Leading Risk Management Software by G2

Achieving Compliance Mastery with Pirani

How to make a risk matrix for your company

Best Risk Management Software: Top 10 Reviews & Pros/Cons

No Comments Yet

Let us know what you think