5 steps for financial risk analysis

Financial risk analysis is all about evaluating the likelihood of a threat occurring and assessing its potential impact. This process is crucial in risk management because it helps businesses anticipate financial threats and prepare to mitigate them before they cause significant damage.

What Is Financial Risk Management?

Financial risk management involves calculating the potential impact of a risk and determining the level of exposure a company faces. However, assessing risk is rarely straightforward—one risk event can trigger multiple consequences.

For instance, if a machine breaks down, the issue isn’t just the mechanical damage that needs repairing. Production is interrupted, deadlines are missed, financial losses accumulate, and even the company’s reputation might suffer.

How to Start a Financial Risk Analysis?

A thorough financial risk analysis begins with identifying all potential risk events. The goal isn’t just to estimate potential losses but to prevent them from happening in the first place.

For example, in credit risk analysis, a key type of financial risk, banks assess the likelihood that a borrower may default on their loan. This information allows them to take preventive measures, such as adjusting interest rates or requiring additional collateral.

To manage financial risks effectively, companies must consider both internal and external risk factors:

-

Internal factors stem from within the company, such as cash flow mismanagement or operational inefficiencies. These risks can directly impact the company’s financial health and market value.

-

External factors include economic downturns, currency fluctuations, industry trends, and regulatory changes—elements outside the company’s control but with significant financial implications.

How to Evaluate Financial Risk Exposure?

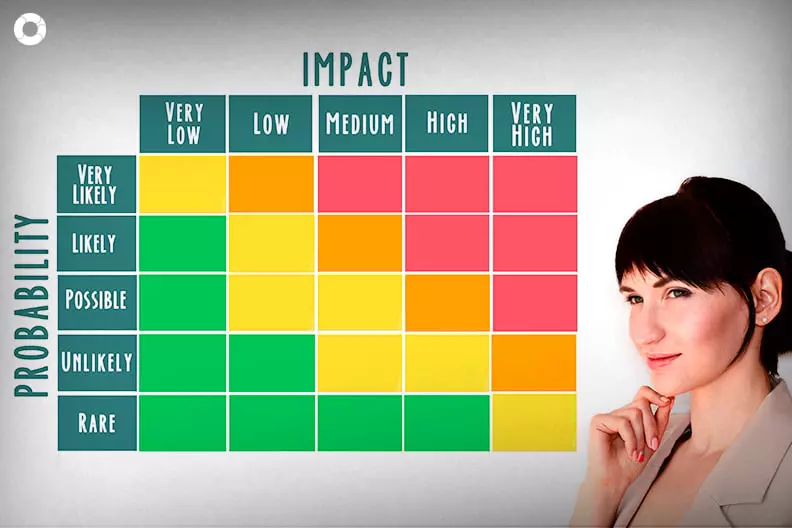

The easiest way to conduct a financial risk analysis is to combine the probability of a risk occurring with its potential financial impact.

Once risks are identified and the right control measures are selected, the company must decide whether to avoid or accept the risks based on its risk appetite and tolerance levels.

Quantifying risk exposure is essential. If a risk only affects a single department, its impact can be estimated by multiplying its probability by the expected financial loss. This helps create risk heat maps, visually highlighting which risks are manageable and which require immediate attention.

However, decision-making should also factor in market trends, macroeconomic conditions, and financial variables. Since managing financial risk involves multiple dynamic elements, using real-time risk detection tools can enhance accuracy and efficiency.

Why Use Risk Management Software?

Advanced risk management software like Pirani automates financial risk assessments, reducing manual work and minimizing subjective errors. A robust technological solution allows businesses to identify, measure, control, and monitor risks effectively—helping prevent risk materialization or mitigate impact if an event occurs.

5 Essential Steps for Managing Financial Risk

Step 1: Identify Key Risks

Start by pinpointing all potential financial risks that could impact your business. These risks may include:

-

Competitiveness issues (costs, pricing, inventory fluctuations)

-

Industry shifts and evolving market demands

-

Regulatory and compliance changes

-

Technological advancements

-

Workforce and leadership changes

Step 2: Assess Risk Severity

Prioritizing risks ensures that resources are allocated efficiently. Not all risks require the same level of attention, so ranking them helps businesses focus on the most critical threats first.

Step 3: Develop a Contingency Plan

Once risks are identified, businesses should design specific mitigation strategies. Not all risks can be controlled, but a well-structured contingency plan will outline preventive and reactive measures aligned with the company’s risk appetite.

Step 4: Assign Risk Management Responsibilities

While it may not be possible to assign ownership for every risk, ensuring that key risks have dedicated monitoring personnel is vital. Delegating responsibilities prevents risk oversight and ensures a proactive response to emerging threats.

Step 5: Set Deadlines for Risk Mitigation Plans

Risk mitigation actions should be time-bound to prevent threats from escalating. Defining timelines allows businesses to track progress and adjust strategies when necessary.

By following these steps and implementing a structured financial risk management framework, companies can enhance their resilience against economic uncertainties. To streamline the process, businesses can use risk management software to centralize risk tracking, automate reporting, and improve decision-making.

Looking for a financial risk management checklist? Download our free template and start safeguarding your company’s financial future today!

You May Also Like

These Related Stories

Reputational Risk: Definition, Examples, & Proper Management

Prioritize risk with a control matrix

How to make a risk matrix for your company

Predictive KRIs: Transform Risk Management with Data-Driven Scoring

Risk management for software projects

Comments (1)