Key competencies and skills a risk manager should have

Key competencies and skills a risk manager should have

5:20

One of the most important aspects of risk management is having the right people to carry out this process efficiently and effectively. This will allow an organization to generate real value and make strategic decisions in a timely manner.

In this sense, risk professionals, from analysts and managers to managers or directors, must be highly qualified for the functions they are in charge of, as they contribute to protecting the organization's sustainability and continuity over time.

Below, we share some of the technical competencies and interpersonal or socioemotional skills that are currently key for a risk manager. These help them respond more accurately to the constant changes and challenges of the organizational world.

Technical skills

Among others, the main technical competencies that a risk manager should have today are:

Every risk manager should know and be guided in his work by the recommendations of standards such as ISO 31000, the COSO framework, the Australian Risk Management Standard, or others specific to the economic sector of the organization. These norms and standards serve, among other things, to guide the identification, measurement, control, and monitoring of risks.

2. Comprehensive knowledge of the business

For adequate risk management, it is essential to know and understand the internal and external context of the business, how it works, its strategic areas, the particularities of the sector, etc. Having this in-depth knowledge helps the risk manager identify potential threats and opportunities that can be exploited in the different areas of the organization. Surveys, staff interviews, and tools such as the SWOT matrix (SWOT, SWOT) or PESTEL analysis are useful for understanding the business.

3. Risk analysis

This implies a good understanding of the risks, their probabilities, their causes, and the impact they would have on the organization. Likewise, the risk manager must be able to analyze whether the treatment for the risks is efficient and know how to measure the behavior and evolution of each of these over time and what decisions to make.

4. Statistical knowledge and financial analysis

A basic knowledge of statistics can be very useful to the risk manager in applying quantitative models for measuring and evaluating risks. On the other hand, financial analysis allows the manager to evaluate risks considering the economic/financial impacts and, in turn, to use the resources available to him/her efficiently.

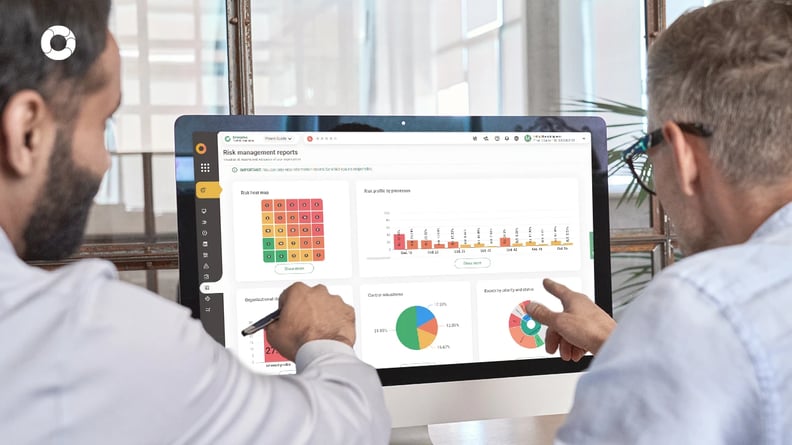

5. Knowledge of technological tools

To do a better job, risk managers should rely on technological tools such as risk management and data analysis software, which allow them to save time, reduce errors, and be more precise and strategic. Therefore, it is increasingly important to know about technologies such as big data, machine learning, and other tools or applications that help simplify management.

Interpersonal or socioemotional skills

In addition to technical skills, which are essential to perform as a risk manager, it is essential to have socioemotional skills, popularly misnamed "soft skills." Among these, we can highlight the following:

1. Clear and assertive communication.

The risk manager must know how to communicate clearly with senior management to inform them about their work and the results achieved, as well as communicate assertively with the staff of the different areas and stakeholders to request information, listen and resolve their doubts, train them in the process, etc. At all times, he/she must make himself/herself understood and convincing in oral and written communication.

2. Decision making

Based on his or her technical knowledge, the risk manager must make decisions independently, always considering the organization's best interest.

3. Leadership

As the person responsible for risk management, this skill is important for leading and guiding others in the process. It also involves knowing how to work in a team, collaborate, build trust, inspire, and empathize with others.

4. Adaptability

It is key for the risk manager to adapt quickly to the ever-changing environment and adjust management strategies accordingly.

5. Curiosity and continuous updating

To be a better risk manager and have strategic thinking, it is necessary to be constantly updated and informed about what is happening in the political, economic, social, technological, legal, and ecological environment and how it can affect the organization and be prepared for this.

In addition, interacting with other risk professionals in different academic scenarios (seminars, courses, congresses, among others) is advisable to learn about trends, experiences, and best practices that can be applied in the organization to achieve better results.

The combination of technical competencies and interpersonal skills, such as the above, undoubtedly helps risk managers perform their work more efficiently and thus contribute to the generation and protection of the organization's value.

What other competencies and skills would you add? Leave us your comments.

You May Also Like

These Related Stories

Steps to implement a risk management system

Steps to implement a risk management system

November 25, 2024

4

min read

Manage your suspicious transactions

Manage your suspicious transactions

March 09, 2023

2

min read

How to identify unusual or suspicious transactions

How to identify unusual or suspicious transactions

October 14, 2022

2

min read

Risk management for software projects

Risk management for software projects

July 01, 2024

5

min read

The 4 key steps to cybersecurity risk management

The 4 key steps to cybersecurity risk management

June 24, 2024

5

min read

Ozark, a Netflix series to understand money laundering

Ozark, a Netflix series to understand money laundering

December 18, 2019

2

min read

Comments (1)